COMPANY REGISTRATION IN BANGLADESH

COMPANY REGISTRATION IN BANGLADESH (বাংলাদেশে কোম্পানি নিবন্ধন)

REGISTERING A LIMITED COMPANY IN BANGLADESH INVOLVES SEVERAL STEPS, AND WHILE THE PROCESS CAN TAKE TIME, FOLLOWING THESE GUIDELINES CAN HELP MAKE IT AS FAST AND ERROR-FREE AS POSSIBLE:

বাংলা:

বাংলাদেশে একটি লিমিটেড কোম্পানি নিবন্ধন করতে হলে কয়েকটি ধাপ অনুসরণ করতে হয়। প্রক্রিয়াটি সময়সাপেক্ষ হতে পারে, তবে নিচের নির্দেশনা মেনে চললে এটি দ্রুত ও ভুলবিহীনভাবে সম্পন্ন করা সম্ভব):

THIS IS THE ULTIMATE SOLUTION AND FULL GUIDELINE, YOU WILL LEARN HOW TO INCORPORATE YOUR PRIVATE LIMITED COMPANY IN BANGLADESH

বাংলা:

এটি হলো চূড়ান্ত সমাধান এবং পূর্ণাঙ্গ নির্দেশিকা, যার মাধ্যমে আপনি বাংলাদেশে কীভাবে আপনার প্রাইভেট লিমিটেড কোম্পানি নিবন্ধন (ইনকর্পোরেশন) করবেন তা শিখতে পারবেন:

Incorporating a private limited company is a significant step for entrepreneurs in Bangladesh, marking the commencement of a formal business journey. It provides a legal identity to the business and offers limited liability protection to its shareholders, potentially enhancing the entity’s credibility and attractiveness to investors. Though steep in potential rewards, the process is entangled with various legal requirements, including drafting a Memorandum of Association (MoA), which outlines the company’s constitution and defines its relationship with shareholders.

বাংলা:

বাংলাদেশের উদ্যোক্তাদের জন্য একটি প্রাইভেট লিমিটেড কোম্পানি নিবন্ধন করা (Incorporation) একটি গুরুত্বপূর্ণ পদক্ষেপ, যা একটি আনুষ্ঠানিক ব্যবসায়িক যাত্রার সূচনা নির্দেশ করে। এটি ব্যবসার একটি স্বতন্ত্র আইনগত সত্ত্বা প্রদান করে এবং শেয়ারহোল্ডারদের জন্য সীমিত দায় (Limited Liability) সুরক্ষা নিশ্চিত করে। ফলে প্রতিষ্ঠানের বিশ্বাসযোগ্যতা বৃদ্ধি পায় এবং বিনিয়োগকারীদের কাছে এটি আরও আকর্ষণীয় হয়ে ওঠে।

তবে সম্ভাবনার দিক থেকে লাভজনক হলেও, এই প্রক্রিয়াটি নানা আইনগত শর্তের সঙ্গে জড়িয়ে আছে। এর মধ্যে অন্যতম হলো মেমোরেন্ডাম অব অ্যাসোসিয়েশন (MoA) প্রস্তুত করা, যেখানে কোম্পানির সংবিধান নির্ধারণ করা হয় এবং শেয়ারহোল্ডারদের সঙ্গে কোম্পানির সম্পর্ক স্পষ্টভাবে সংজ্ঞায়িত করা হয়।

Some common features of the RJSC website: That makes the company registration journey easier and smoother.

RJSC :: Fee Calculator

Fee Calculator: You can calculate the fee for your any submission to RJSC from this page.

::: RJSC ::: Entity Name Search

Search Entity Name ; Use this page to see whether a proposed name of your new entity resembles to the already registered or booked entity names. Proposed name(s) …

:: RJSC :: Submission Status

You can check your submission status at RJSC web. Enter Submission No.

By using the above-mentioned reference: You can know your company’s registration fee also you can choose a suitable name for your company and finally you can check your company’s registration last status.

আরজেএসসি (RJSC) ওয়েবসাইটের কিছু সাধারণ বৈশিষ্ট্য:

যা কোম্পানি নিবন্ধনের যাত্রাকে আরও সহজ ও মসৃণ করে তোলে।

RJSC :: Fee Calculator

ফি ক্যালকুলেটর: এই পেজ থেকে আপনি আরজেএসসি-তে আপনার যেকোনো সাবমিশনের ফি হিসাব করতে পারবেন।::: RJSC ::: Entity Name Search

সার্চ এন্টিটি নেম: এই পেজ ব্যবহার করে আপনি আপনার প্রস্তাবিত কোম্পানির নাম পূর্বে নিবন্ধিত বা সংরক্ষিত কোনো নামের সঙ্গে মিল রয়েছে কি না তা যাচাই করতে পারবেন।:: RJSC :: Submission Status

আপনি আরজেএসসি ওয়েবসাইটে আপনার সাবমিশন স্ট্যাটাস চেক করতে পারবেন। কেবলমাত্র সাবমিশন নাম্বার প্রবেশ করালেই হবে।

উপরোক্ত রেফারেন্স ব্যবহার করে আপনি আপনার কোম্পানির নিবন্ধন ফি জানতে পারবেন, কোম্পানির জন্য একটি উপযুক্ত নাম নির্বাচন করতে পারবেন এবং শেষ পর্যন্ত নিবন্ধনের সর্বশেষ অবস্থা যাচাই করতে পারবেন।

This article delves into the intricacies of forming a private limited company in Bangladesh, beginning with pre-registration requirements such as choosing a unique company name and understanding the roles of directors and shareholders. It also covers the essential components of the MoA, capital necessities, and the comprehensive list of documents needed for registration. Subsequently, the piece provides a step-by-step guide through the registration procedure, followed by post-incorporation obligations and return filing requirements, thereby equipping readers with the knowledge to navigate the incorporation process proficiently.

এই নিবন্ধে বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানি গঠনের জটিলতা নিয়ে বিস্তারিত আলোচনা করা হয়েছে। শুরু করা হয়েছে প্রাক-নিবন্ধন শর্তাবলি দিয়ে, যেমন— একটি স্বতন্ত্র কোম্পানির নাম নির্বাচন করা এবং পরিচালক ও শেয়ারহোল্ডারদের ভূমিকা বোঝা।

এছাড়া এখানে অন্তর্ভুক্ত রয়েছে—

MoA (Memorandum of Association)-এর গুরুত্বপূর্ণ উপাদানসমূহ,

মূলধনের প্রয়োজনীয়তা,

নিবন্ধনের জন্য প্রয়োজনীয় পূর্ণাঙ্গ নথির তালিকা।

পরবর্তীতে ধাপে ধাপে নিবন্ধন প্রক্রিয়ার নির্দেশিকা তুলে ধরা হয়েছে। এর সঙ্গে রয়েছে ইনকর্পোরেশনের পরবর্তী দায়িত্বসমূহ এবং রিটার্ন দাখিলের প্রয়োজনীয়তা।

সব মিলিয়ে, পাঠকরা এই নিবন্ধ থেকে বাংলাদেশে কোম্পানি নিবন্ধন প্রক্রিয়াটি দক্ষতার সঙ্গে সম্পন্ন করার জন্য প্রয়োজনীয় জ্ঞান ও দিকনির্দেশনা লাভ করতে পারবেন।

TIPS FOR FAST AND ERRORLESS REGISTRATION:

- Double-check Documentation: Ensure all documents are accurate and complete to avoid delays.

- Use Professional Services: Consider hiring a legal or consulting firm to assist with the process.

- Stay Updated: Keep informed about any changes in regulations or procedures by visiting the RJSC website.

- Online Application: Utilize online services for faster processing, as they can be quicker than traditional methods.

By following these steps and tips, you can streamline the process of registering a limited company in Bangladesh.

দ্রুত ও ভুলবিহীন নিবন্ধনের জন্য পরামর্শ (Tips for Fast and Errorless Registration):

ডকুমেন্ট দ্বিগুণভাবে যাচাই করুন: সব কাগজপত্র সঠিক ও সম্পূর্ণ আছে কি না নিশ্চিত করুন, যাতে দেরি না হয়।

পেশাদার সেবা গ্রহণ করুন: আইনি বা কনসালটিং ফার্মের সহায়তা নেওয়ার কথা বিবেচনা করতে পারেন, যাতে প্রক্রিয়াটি সহজ হয়।

সর্বশেষ তথ্য জানুন: আরজেএসসি (RJSC) ওয়েবসাইট ভিজিট করে নিয়ম-কানুন বা প্রক্রিয়ায় কোনো পরিবর্তন হলে তা সম্পর্কে আপডেট থাকুন।

অনলাইন আবেদন ব্যবহার করুন: অনলাইনে আবেদন করলে প্রসেসিং দ্রুত হয়, যা প্রচলিত পদ্ধতির চেয়ে কার্যকর হতে পারে।

উপরোক্ত ধাপ ও পরামর্শগুলো অনুসরণ করলে, বাংলাদেশে একটি লিমিটেড কোম্পানি নিবন্ধনের প্রক্রিয়াটি আরও সহজ, দ্রুত ও নির্ভুলভাবে সম্পন্ন করা সম্ভব।

PRE-REGISTRATION REQUIREMENTS:

Pre-registration requirements are an important part of ensuring company Incorporation or Registration in Bangladesh.

পূর্ব-নিবন্ধন শর্তাবলি (Pre-Registration Requirements):

পূর্ব-নিবন্ধন শর্তাবলি হলো বাংলাদেশে কোম্পানি ইনকর্পোরেশন বা নিবন্ধন নিশ্চিত করার জন্য একটি গুরুত্বপূর্ণ অংশ।

KEY FACTS ABOUT COMPANY FORMATION

Before the incorporation of a private limited company in Bangladesh, it is crucial to secure approval for the proposed company name from the Registrar of Joint Stock Companies and Firms (RJSC). The RJSC is the primary regulatory body overseeing company registrations in Bangladesh.

কোম্পানি গঠনের গুরুত্বপূর্ণ তথ্য (Key Facts About Company Formation):

বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানি ইনকর্পোর করার আগে, প্রস্তাবিত কোম্পানির নামের অনুমোদন (Name Approval) নেওয়া অত্যন্ত গুরুত্বপূর্ণ। এই অনুমোদন প্রদান করে থাকে Registrar of Joint Stock Companies and Firms (RJSC), যা বাংলাদেশে কোম্পানি নিবন্ধনের প্রধান নিয়ন্ত্রক সংস্থা।

THE REGISTRAR OF JOINT STOCK COMPANIES AND FIRMS (RJSC)

RJSC plays a pivotal role in the registration of companies and the acceptance of returns, thereby maintaining the integrity of company records in Bangladesh. The process of name clearance is a critical step managed by RJSC, where entrepreneurs must submit a name clearance application through the RJSC website, pay the prescribed fee, and await approval. The name clearance, once approved, is valid for 30 days for companies and 180 days for societies, during which the registration application must be filed.

RJSC বাংলাদেশের কোম্পানি নিবন্ধন এবং রিটার্ন গ্রহণে একটি গুরুত্বপূর্ণ ভূমিকা পালন করে, যার মাধ্যমে কোম্পানির রেকর্ডের স্বচ্ছতা ও যথার্থতা বজায় থাকে।

নাম অনুমোদন প্রক্রিয়া:

নাম অনুমোদন RJSC পরিচালিত একটি গুরুত্বপূর্ণ ধাপ, যেখানে উদ্যোক্তাদের RJSC ওয়েবসাইটের মাধ্যমে নাম অনুমোদনের জন্য আবেদন জমা দিতে হয়, নির্ধারিত ফি পরিশোধ করতে হয় এবং অনুমোদনের জন্য অপেক্ষা করতে হয়।

নাম অনুমোদন একবার অনুমোদিত হলে কোম্পানির জন্য ৩০ দিন এবং সোসাইটির জন্য ১৮০ দিন বৈধ থাকে, যার মধ্যে নিবন্ধনের আবেদন জমা দিতে হয়।

COMPANY NAME APPROVAL

To enhance the likelihood of quick name approval, the proposed name should not be identical or too similar to existing company names, infringe on any trademarks, or be deemed obscene or vulgar. The name should not be already reserved under someone else’s application. After obtaining name clearance, the name is reserved for 30 days, extendable by filing a new application before the expiry date.

Entrepreneurs are advised to engage professional firms to facilitate the name clearance application, ensuring that all requirements are meticulously met. Once the name is cleared, shareholders must liaise with a Bangladeshi bank to open a temporary bank account for share capital remittance, providing necessary documents like a draft memorandum, articles of association, and a copy of the name clearance approval certificate. Upon bank approval, shareholders must remit the share capital and obtain an encashment certificate, unless the shareholders include Bangladeshi citizens, in which case this requirement is waived.

কোম্পানি নাম অনুমোদন (Company Name Approval)

দ্রুত নাম অনুমোদনের সম্ভাবনা বাড়ানোর জন্য, প্রস্তাবিত নামটি পূর্বে নিবন্ধিত কোম্পানির নামের সঙ্গে একই বা অত্যধিক সাদৃশ্যপূর্ণ, কোনো ট্রেডমার্ক লঙ্ঘনকারী, বা অশ্লীল/অশোভন হওয়া উচিত নয়। এছাড়াও, নামটি অন্য কারো আবেদন অনুসারে আগে থেকেই সংরক্ষিত থাকা উচিত নয়।

নাম অনুমোদন পাওয়ার পর এটি ৩০ দিনের জন্য সংরক্ষিত থাকে, যা মেয়াদ শেষ হওয়ার আগে নতুন আবেদন জমা দিলে সম্প্রসারিত করা যায়।

উদ্যোক্তাদের পরামর্শ দেওয়া হয় যে, পেশাদার ফার্মের সহায়তা নিন, যাতে নাম অনুমোদনের আবেদন প্রক্রিয়া সঠিকভাবে সম্পন্ন হয়।

নাম অনুমোদন পাওয়ার পর:

শেয়ারহোল্ডারদের একটি বাংলাদেশি ব্যাংকে অস্থায়ী ব্যাংক অ্যাকাউন্ট খুলতে হবে শেয়ার ক্যাপিটাল জমার জন্য।

প্রয়োজনীয় ডকুমেন্ট যেমন ড্রাফট মেমোরেন্ডাম, অ্যার্টিকলস অব অ্যাসোসিয়েশন এবং নাম অনুমোদন সনদ কপি ব্যাংকে জমা দিতে হবে।

ব্যাংক অনুমোদনের পরে শেয়ার ক্যাপিটাল জমা দিতে হবে এবং ইনক্যাশমেন্ট সার্টিফিকেট সংগ্রহ করতে হবে, যদি না শেয়ারহোল্ডারের মধ্যে বাংলাদেশের নাগরিক থাকে, তখন এই শর্ত প্রযোজ্য হয় না।

DIRECTOR REQUIREMENTS

In Bangladesh, a private limited company must have a minimum of two directors. These directors can be either local or foreign nationals. It is mandatory that each director is at least 18 years of age and must not have been declared bankrupt or convicted of any offense in the past. Furthermore, directors must hold qualification shares as stated in the Articles of Association. In instances where a shareholder is not a natural person, such as a company, a nominee director may be appointed on its behalf.

ডিরেক্টরের শর্তাবলি (Director Requirements)

বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানিতে ন্যূনতম দুইজন ডিরেক্টর থাকা আবশ্যক। এই ডিরেক্টররা স্থানীয় বা বিদেশি নাগরিক উভয়ই হতে পারেন।

ডিরেক্টরের জন্য শর্তাবলি:

প্রতিটি ডিরেক্টরের বয়স অন্তত ১৮ বছর হতে হবে।

পূর্বে দেউলিয়া ঘোষণা বা কোনো অপরাধে দোষী সাব্যস্ত হওয়া যাবে না।

ডিরেক্টরদের অবশ্যই Articles of Association-এ উল্লেখিত যোগ্য শেয়ার (Qualification Shares) থাকতে হবে।

যদি শেয়ারহোল্ডার একজন প্রাকৃতিক ব্যক্তি না হন, যেমন কোনো কোম্পানি, তবে তার পক্ষ থেকে নমিনি ডিরেক্টর (Nominee Director) নিয়োগ করা যেতে পারে।

SHAREHOLDER REQUIREMENTS

A private limited company in Bangladesh can have between 2 and 50 shareholders. These shareholders can be individuals or legal entities such as another company or trust. Both local and foreign shareholding is permitted, with the possibility of 100% foreign ownership. Shareholders have the flexibility to issue new shares or transfer existing shares at any time after the company has been incorporated.

শেয়ারহোল্ডারের শর্তাবলি (Shareholder Requirements)

বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানিতে ২ থেকে ৫০ জন শেয়ারহোল্ডার থাকতে পারে।

শেয়ারহোল্ডারের ধরন:

প্রাকৃতিক ব্যক্তি (Individuals)

আইনি সত্তা (Legal Entities), যেমন অন্য কোম্পানি বা ট্রাস্ট

স্থানীয় ও বিদেশি উভয় শেয়ারহোল্ডার অনুমোদিত, এবং কোম্পানিতে ১০০% বিদেশি মালিকানাও সম্ভব।

কোম্পানি ইনকর্পোরেশনের পর শেয়ারহোল্ডাররা যেকোনো সময় নতুন শেয়ার ইস্যু করতে বা বিদ্যমান শেয়ার স্থানান্তর করতে পারেন।

AUTHORIZED CAPITAL

The Memorandum of Association and Articles of Association must specify the amount of authorized capital. This represents the maximum share capital that the company is authorized to issue to shareholders. A portion of this authorized capital may remain unissued, with no minimum or maximum limit set for local companies in Bangladesh. However, to facilitate expatriation and the employment of foreign expatriates, a minimum investment of USD 50,000 is generally required.

অথরাইজড ক্যাপিটাল (Authorized Capital)

মেমোরেন্ডাম অব অ্যাসোসিয়েশন (MoA) এবং অ্যার্টিকলস অব অ্যাসোসিয়েশন (AoA)-এ অবশ্যই অথরাইজড ক্যাপিটালের পরিমাণ উল্লেখ করতে হবে। এটি কোম্পানিকে শেয়ারহোল্ডারদের জন্য সর্বোচ্চ শেয়ার ক্যাপিটাল ইস্যু করার অনুমোদন দেয়।

অথরাইজড ক্যাপিটালের একটি অংশ অপ্রকাশিত (Unissued) থাকতে পারে, এবং বাংলাদেশে স্থানীয় কোম্পানির জন্য এর ন্যূনতম বা সর্বাধিক সীমা নির্ধারিত নেই।

তবে বিদেশি কর্মী নিয়োগ বা বিদেশি বিনিয়োগ সুবিধার জন্য সাধারণত ন্যূনতম বিনিয়োগ ৫০,০০০ মার্কিন ডলার (USD) প্রয়োজন।

PAID-UP CAPITAL

For the registration of a company in Bangladesh, the minimum paid-up capital required is Taka 1 for local companies and USD 50,000 for foreign-owned companies. Paid-up capital, also known as share capital, can be increased at any time after the company’s incorporation. This capital is the actual amount of money received from shareholders in exchange for shares.

পেইড-আপ ক্যাপিটাল (Paid-Up Capital)

বাংলাদেশে কোম্পানি নিবন্ধনের জন্য ন্যূনতম পেইড-আপ ক্যাপিটাল হলো:

স্থানীয় কোম্পানি: ১ টাকা

বিদেশি মালিকানাধীন কোম্পানি: ৫০,০০০ মার্কিন ডলার (USD)

পেইড-আপ ক্যাপিটালকে শেয়ার ক্যাপিটাল হিসাবেও ডাকা হয় এবং এটি কোম্পানি ইনকর্পোরেশনের পর যেকোনো সময় বাড়ানো যেতে পারে।

এই ক্যাপিটাল হলো শেয়ারহোল্ডারদের থেকে শেয়ার বিনিময়ে প্রকৃত অর্থ গ্রহণের পরিমাণ।

GOVERNMENT FEES

The government fees associated with the incorporation of a company in Bangladesh are calculated based on the declared authorized capital. These fees include registration fees, stamp duty, and the cost of certified copies, among others. The specific charges are detailed in the Companies Act and vary depending on the amount of authorized capital and the documents filed during the registration process.

Check the company registration fee yourself by Using the RJSC Calculator.

সরকারি ফি (Government Fees)

বাংলাদেশে কোম্পানি ইনকর্পোরেশনের সঙ্গে সম্পর্কিত সরকারি ফি ঘোষিত অথরাইজড ক্যাপিটালের উপর নির্ভর করে নির্ধারিত হয়। এই ফিগুলো অন্তর্ভুক্ত:

নিবন্ধন ফি (Registration Fees)

স্ট্যাম্প ডিউটি (Stamp Duty)

সার্টিফাইড কপি খরচ (Cost of Certified Copies)

এবং অন্যান্য সংশ্লিষ্ট খরচ

ফি সম্পর্কিত বিস্তারিত তথ্য Companies Act-এ উল্লেখিত রয়েছে এবং তা অথরাইজড ক্যাপিটাল ও নিবন্ধনের সময় জমা দেওয়া নথি অনুযায়ী পরিবর্তিত হতে পারে।

আপনি RJSC Fee Calculator ব্যবহার করে নিজেই কোম্পানি নিবন্ধনের ফি যাচাই করতে পারেন।

REQUIRED DOCUMENTS

NAME CLEARANCE

For the incorporation of a private limited company in Bangladesh, obtaining a name clearance from the Registrar of Joint Stock Companies and Firms (RJSC) is mandatory. Applicants must submit a name clearance application along with the proposed company name to RJSC. Upon approval, this clearance confirms that the name does not closely resemble any existing company names or trademarks.

প্রয়োজনীয় নথি (Required Documents)

নাম অনুমোদন (Name Clearance)

বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানি ইনকর্পোর করার জন্য Registrar of Joint Stock Companies and Firms (RJSC) থেকে নাম অনুমোদন নেওয়া আবশ্যক।

নাম অনুমোদনের জন্য আবেদনকারীকে প্রস্তাবিত কোম্পানির নামসহ নাম অনুমোদনের আবেদন RJSC-তে জমা দিতে হবে। অনুমোদন পাওয়ার পর এই clearance নিশ্চিত করে যে নামটি কোনো বিদ্যমান কোম্পানি নাম বা ট্রেডমার্কের সঙ্গে অত্যধিক সাদৃশ্যপূর্ণ নয়।

MEMORANDUM AND ARTICLES OF ASSOCIATION

The Memorandum of Association (MoA) and Articles of Association (AoA) are crucial documents for company registration. The MoA should outline the company’s primary business objectives and include details such as the amount of authorized and paid-up capital, and a list of shareholders with their respective shareholdings. RJSC requires the object clause in the MoA to be concise, typically within 1000 words and limited to 7 clauses. Both the MoA and AoA must be drafted carefully to define the company’s constitution and operational framework.

মেমোরেন্ডাম ও অ্যার্টিকলস অব অ্যাসোসিয়েশন (Memorandum and Articles of Association)

Memorandum of Association (MoA) এবং Articles of Association (AoA) হলো কোম্পানি নিবন্ধনের জন্য অত্যন্ত গুরুত্বপূর্ণ নথি।

MoA:

কোম্পানির মূল ব্যবসায়িক উদ্দেশ্য স্পষ্টভাবে উল্লেখ করতে হবে।

এতে অথরাইজড ও পেইড-আপ ক্যাপিটাল, শেয়ারহোল্ডারদের নাম এবং তাদের শেয়ার হোল্ডিং এর তালিকা অন্তর্ভুক্ত থাকতে হবে।

RJSC-এর জন্য MoA-এর অবজেক্ট ক্লজ সংক্ষিপ্ত হওয়া প্রয়োজন, সাধারণত ১০০০ শব্দের মধ্যে এবং সর্বোচ্চ ৭টি ক্লজ সীমাবদ্ধ।

MoA ও AoA:

সাবধানে প্রস্তুত করতে হবে যাতে কোম্পানির সংবিধান ও কার্যক্রমের কাঠামো সুস্পষ্টভাবে নির্ধারিত থাকে।

SHAREHOLDERS AND DIRECTORS PARTICULARS

Detailed particulars of shareholders and directors are necessary for the registration process. This includes their full names, addresses, parents’ names, passport details, and photographs. If the directors or shareholders are Bangladeshi nationals, their National ID (NID) and Tax Identification Number (TIN) are also required. For foreign nationals, passport copies must be submitted.

শেয়ারহোল্ডার ও ডিরেক্টরের বিস্তারিত তথ্য (Shareholders and Directors Particulars)

কোম্পানি নিবন্ধনের প্রক্রিয়ার জন্য শেয়ারহোল্ডার ও ডিরেক্টরের বিস্তারিত তথ্য অত্যাবশ্যক। এতে অন্তর্ভুক্ত:

পূর্ণ নাম

ঠিকানা

পিতামাতার নাম

পাসপোর্টের বিবরণ

ছবি

বাংলাদেশি নাগরিকদের জন্য:

জাতীয় পরিচয়পত্র (NID)

ট্যাক্স আইডেন্টিফিকেশন নম্বর (TIN)

বিদেশি নাগরিকদের জন্য:

পাসপোর্টের কপি জমা দিতে হবে।

REGISTERED ADDRESS

A local address in Bangladesh must be provided as the registered address of the company. This address can be either residential, commercial, or industrial. It serves as the official address for all formal communications and legal notices.

নিবন্ধিত ঠিকানা (Registered Address)

কোম্পানির নিবন্ধিত ঠিকানা হিসেবে বাংলাদেশে একটি স্থানীয় ঠিকানা প্রদান করা আবশ্যক।

এটি হতে পারে বাসভিত্তিক (Residential), বাণিজ্যিক (Commercial) বা শিল্পকেন্দ্রিক (Industrial) ঠিকানা।

এই ঠিকানা কোম্পানির সকল আনুষ্ঠানিক যোগাযোগ এবং আইনগত নোটিশের জন্য অফিসিয়াল ঠিকানা হিসেবে ব্যবহৃত হবে।

SIGNED FORM IX AND SUBSCRIBER PAGE

Form IX, which is the consent of the director to act, along with the subscriber page, needs to be filled out and signed by the proposed directors. These documents confirm the willingness and consent of the individuals to act as directors of the company. Scanned copies of these signed documents are required for submission to RJSC.

সাইন করা ফর্ম IX এবং সাবস্ক্রাইবার পেজ (Signed Form IX and Subscriber Page)

Form IX হলো ডিরেক্টরের কর্ম করার সম্মতি পত্র (Consent of Director to Act)। এটি সাবস্ক্রাইবার পেজের সঙ্গে প্রস্তাবিত ডিরেক্টরদের দ্বারা পূরণ ও স্বাক্ষরিত হতে হবে।

এই নথিগুলো নিশ্চিত করে যে ব্যক্তিরা কোম্পানির ডিরেক্টর হিসেবে কাজ করার জন্য ইচ্ছুক এবং সম্মত।

RJSC-তে জমার জন্য এই স্বাক্ষরিত নথিগুলোর স্ক্যান করা কপি প্রয়োজন।

ENCASHMENT CERTIFICATE

An encashment certificate is issued by the bank once the share capital is remitted by the shareholders. This certificate is crucial as it verifies the amount of foreign remittance received by the bank, which is a mandatory step for foreign investors or companies with foreign shareholding. The certificate must be submitted to RJSC as part of the registration documentation.

ইনক্যাশমেন্ট সার্টিফিকেট (Encashment Certificate)

শেয়ারহোল্ডাররা শেয়ার ক্যাপিটাল জমা দেওয়ার পর ব্যাংক থেকে একটি ইনক্যাশমেন্ট সার্টিফিকেট ইস্যু করা হয়।

এটি গুরুত্বপূর্ণ কারণ এটি বিদেশি রেমিট্যান্সের পরিমাণ ব্যাংক দ্বারা প্রাপ্ত হয়েছে তা নিশ্চিত করে।

এটি বিদেশি বিনিয়োগকারী বা বিদেশি শেয়ারহোল্ডারদের জন্য আবশ্যক ধাপ।

নিবন্ধনের জন্য RJSC-তে এই সার্টিফিকেট জমা দিতে হয়।

REGISTRATION PROCEDURE

STEP 1: NAME CLEARANCE

The first step to initiate the registration of a private limited company in Bangladesh involves obtaining a name clearance. Now visit www.roc.gov.bd to create a username and apply for name clearance. After applying, a bank payment slip is issued, and BDT. 500 (Fee) + BDT. 75 (VAT) needs to be paid at the designated bank. Once payment is confirmed, the RJSC website will update the status to show that the name clearance has been granted and the Submission status shown: Approved.

নিবন্ধন প্রক্রিয়া (Registration Procedure)

ধাপ ১: নাম অনুমোদন (Step 1: Name Clearance)

বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানি নিবন্ধনের প্রাথমিক ধাপ হলো নাম অনুমোদন (Name Clearance) নেওয়া।

প্রথমে www.roc.gov.bd ওয়েবসাইটে গিয়ে একটি ইউজারনেম তৈরি করুন এবং নাম অনুমোদনের জন্য আবেদন করুন।

আবেদন করার পর একটি ব্যাংক পেমেন্ট স্লিপ ইস্যু হবে।

প্রযোজ্য ফি পরিশোধ করতে হবে: BDT 500 (ফি) + BDT 75 (VAT) নির্ধারিত ব্যাংকে।

পেমেন্ট নিশ্চিত হলে RJSC ওয়েবসাইটে স্ট্যাটাস আপডেট হবে এবং নাম অনুমোদনের Submission Status: Approved দেখাবে।

STEP 2: BANK ACCOUNT OPENING AND BRINGING IN THE PAID-UP CAPITAL (In the Case of Foreign Companies)

Following name clearance, the next step is to open a bank account in the proposed company’s name with any scheduled bank in Bangladesh. This account will act as the primary financial hub for the company’s operations. After the account is opened, the foreign shareholder must remit funds equivalent to their shareholding into this account. This capital injection is a critical prerequisite for the incorporation process, demonstrating the shareholder’s financial commitment to the company.

STEP 3: UPLOADING DOCUMENTS ON THE RJSC WEBSITE

Once the bank account is operational and the paid-up capital has been injected, the next step involves uploading the necessary documents to the RJSC website. This includes scanned copies of Form IX and the Subscriber Page, along with the Encashment Certificate, which confirms the foreign currency has been converted and deposited into the company’s bank account.

ধাপ ৩: RJSC ওয়েবসাইটে নথি আপলোড করা (Step 3: Uploading Documents on the RJSC Website)

ব্যাংক অ্যাকাউন্ট কার্যকর হওয়ার এবং পেইড-আপ ক্যাপিটাল জমা দেওয়ার পর, পরবর্তী ধাপ হলো RJSC ওয়েবসাইটে প্রয়োজনীয় নথি আপলোড করা।

এতে অন্তর্ভুক্ত:

Form IX এর স্ক্যান করা কপি

Subscriber Page

Encashment Certificate, যা নিশ্চিত করে যে বিদেশি মুদ্রা কোম্পানির ব্যাংক অ্যাকাউন্টে রূপান্তরিত ও জমা হয়েছে।

STEP 4: VERIFICATION OF ENCASHMENT CERTIFICATE (

In the Case of Foreign Companies)

After the documents are uploaded, the RJSC conducts an initial verification. If the RJSC officials are satisfied, they will issue a letter to the bank that provided the Encashment Certificate to confirm the authenticity of the funds. Upon receiving a positive response from the bank, RJSC moves forward with the final steps of the registration process.

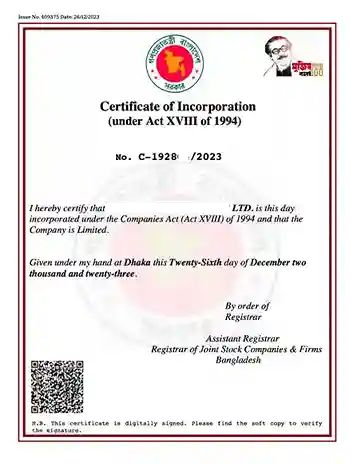

STEP 5: INCORPORATION

Once all verifications are complete and RJSC is satisfied with the documentation and the legitimacy of the financial transactions, the final step is the issuance of the incorporation documents. RJSC will digitally sign and issue the Certificate of Incorporation, Memorandum of Association (MoA), Articles of Association (AoA), and Form XII. These documents are then sent to the email address associated with the RJSC account, officially marking the completion of the company registration process.

ধাপ ৫: ইনকর্পোরেশন (Step 5: Incorporation)

সমস্ত যাচাই-বাছাই সম্পন্ন হলে এবং RJSC নথিপত্র ও আর্থিক লেনদেনের বৈধতা সন্তোষজনকভাবে নিশ্চিত হলে, চূড়ান্ত ধাপ হলো ইনকর্পোরেশন ডকুমেন্ট ইস্যু করা।

RJSC ডিজিটালি স্বাক্ষরিত Certificate of Incorporation, Memorandum of Association (MoA), Articles of Association (AoA), এবং Form XII ইস্যু করবে।

এই নথিগুলো RJSC অ্যাকাউন্টের সঙ্গে যুক্ত ইমেল ঠিকানায় পাঠানো হয়, যা কোম্পানি নিবন্ধন প্রক্রিয়ার সরাসরি সমাপ্তি চিহ্নিত করে।

BENEFITS OF LTD COMPANY

- Limited Liability: Protection of shareholders’ personal assets from company debts.

- Enhanced Credibility: Establishes a professional image and fosters trust with stakeholders.

- Access to Funding: Facilitates securing loans and attracting investments.

- Business Continuity: Ensures the company’s existence remains independent of its founders.

লিমিটেড কোম্পানির সুবিধাসমূহ (Benefits of an LTD Company)

সীমিত দায় (Limited Liability):

শেয়ারহোল্ডারদের ব্যক্তিগত সম্পদ কোম্পানির ঋণ থেকে সুরক্ষিত থাকে।বর্ধিত বিশ্বাসযোগ্যতা (Enhanced Credibility):

পেশাদার ইমেজ প্রতিষ্ঠা করে এবং স্টেকহোল্ডারদের মধ্যে বিশ্বাস তৈরি করে।অর্থায়ন সহজলভ্যতা (Access to Funding):

ঋণ নেওয়া এবং বিনিয়োগ আকৃষ্ট করা সহজ হয়।ব্যবসার স্থায়িত্ব (Business Continuity):

কোম্পানির অস্তিত্ব প্রতিষ্ঠাতাদের ওপর নির্ভরশীল না থেকে স্বাধীনভাবে বজায় থাকে।

POST-INCORPORATION REQUIREMENTS:

After registration as a private limited company, the following things have to be managed properly.

ইনকর্পোরেশনের পরবর্তী শর্তাবলি (Post-Incorporation Requirements)

একটি প্রাইভেট লিমিটেড কোম্পানি হিসেবে নিবন্ধনের পর, নিম্নলিখিত বিষয়গুলো সঠিকভাবে পরিচালনা করতে হবে:

SHARE CERTIFICATES AND REGISTERS

After incorporating a private limited company in Bangladesh, it is essential to issue share certificates to each shareholder. These certificates serve as proof of ownership and include details such as the number of shares owned, the type of shares, and the date of issue. The Company Secretary, responsible for compliance, issues these certificates, which must be signed by two directors or, in the case of a single director, by the director and the Company Secretary. Additionally, companies must maintain a Share Register Book to record all share transactions and transfers, ensuring that all details are up-to-date and accurately reflect the current shareholders.

শেয়ার সার্টিফিকেট ও রেজিস্টার (Share Certificates and Registers)

বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানি ইনকর্পোর করার পর, প্রতিটি শেয়ারহোল্ডারের জন্য শেয়ার সার্টিফিকেট ইস্যু করা অত্যাবশ্যক।

শেয়ার সার্টিফিকেট হলো মালিকানার প্রমাণ, যা অন্তর্ভুক্ত করে:

শেয়ারের সংখ্যা

শেয়ারের ধরন

ইস্যুর তারিখ

সার্টিফিকেট ইস্যু করেন কোম্পানি সেক্রেটারি, যিনি কমপ্লায়েন্সের দায়িত্বে থাকেন।

স্বাক্ষর করতে হবে দুইজন ডিরেক্টর দ্বারা বা একক ডিরেক্টরের ক্ষেত্রে ডিরেক্টর ও কোম্পানি সেক্রেটারি দ্বারা।

অতিরিক্তভাবে, কোম্পানিকে শেয়ার রেজিস্টার বুক (Share Register Book) বজায় রাখতে হবে, যেখানে সব শেয়ার লেনদেন এবং স্থানান্তরের তথ্য সঠিকভাবে নথিভুক্ত থাকবে, যাতে বর্তমান শেয়ারহোল্ডারদের তথ্য সর্বদা আপ-টু-ডেট থাকে।

COMPANY SEALS AND RUBBER STAMPS

Another post-incorporation requirement is the acquisition of a company seal and rubber stamps. These items are crucial for validating official documents and contracts. The company seal, often required by law, is used to emboss documents to confer authenticity. Rubber stamps, on the other hand, are used for day-to-day operations such as endorsing cheques and other routine paperwork.

কোম্পানি সিল ও রাবার স্ট্যাম্প (Company Seals and Rubber Stamps)

ইনকর্পোরেশনের পর আরেকটি গুরুত্বপূর্ণ শর্ত হলো কোম্পানি সিল এবং রাবার স্ট্যাম্প সংগ্রহ করা।

এই আইটেমগুলো আনুষ্ঠানিক নথি ও চুক্তি বৈধ করার জন্য অত্যাবশ্যক।

কোম্পানি সিল: সাধারণত আইন অনুযায়ী প্রয়োজন হয় এবং নথিতে অথেন্টিসিটি নিশ্চিত করতে ব্যবহৃত হয়।

রাবার স্ট্যাম্প: দৈনন্দিন কার্যক্রমে ব্যবহার করা হয়, যেমন চেক অনুমোদন ও অন্যান্য রুটিন কাগজপত্রে স্বাক্ষর।

APPLYING FOR A TRADE LICENSE, TAX IDENTIFICATION NUMBER (TIN) AND BUSINESS IDENTIFICATION NUMBER (BIN)

To operate legally in Bangladesh, newly incorporated companies must apply for a Trade License, Tax Identification Number (TIN), and Business Identification Number (BIN). The Trade License is obtained from the local government and is mandatory for conducting business activities. The process involves selecting a commercial space, either through purchase or lease, and then applying for the license.

Simultaneously, companies must register for a TIN and BIN, which is issued by the National Board of Revenue (NBR). The TIN and BIN are critical requirements for tax and VAT compliance and can be obtained either manually or electronically. The electronic version, known as E-TIN and BIN, is more convenient and can be acquired by submitting an application through the NBR’s official website. Necessary documents for TIN and BIN registration include a copy of the Trade License, the Company Incorporation Certificate, and the Memorandum and Articles of Association and Bank Statements (Bank Statements required for BIN registration). It is essential to ensure that all documents are in order and submitted correctly to avoid delays.

ট্রেড লাইসেন্স, ট্যাক্স আইডেন্টিফিকেশন নম্বর (TIN) এবং বিজনেস আইডেন্টিফিকেশন নম্বর (BIN) এর জন্য আবেদন

বাংলাদেশে বৈধভাবে ব্যবসা পরিচালনার জন্য, নবনিবন্ধিত কোম্পানিগুলিকে ট্রেড লাইসেন্স, TIN এবং BIN-এর জন্য আবেদন করতে হয়।

ট্রেড লাইসেন্স:

স্থানীয় সরকার থেকে প্রাপ্ত হয় এবং ব্যবসায়িক কার্যক্রম পরিচালনার জন্য আবশ্যক।

প্রক্রিয়ার মধ্যে একটি বাণিজ্যিক স্থান নির্বাচন (ক্রয় বা লিজ) এবং লাইসেন্সের জন্য আবেদন অন্তর্ভুক্ত।

TIN এবং BIN:

জাতীয় রাজস্ব বোর্ড (NBR) দ্বারা ইস্যু করা হয়।

এগুলো ট্যাক্স ও VAT কমপ্লায়েন্সের জন্য গুরুত্বপূর্ণ।

ম্যানুয়ালি বা ইলেকট্রনিকভাবে (E-TIN ও E-BIN) আবেদন করা যায়।

ইলেকট্রনিক আবেদন NBR-এর সরকারি ওয়েবসাইট থেকে করা সহজ।

প্রয়োজনীয় নথি:

ট্রেড লাইসেন্সের কপি

কোম্পানি ইনকর্পোরেশন সার্টিফিকেট

মেমোরেন্ডাম ও অ্যার্টিকলস অব অ্যাসোসিয়েশন

ব্যাংক স্টেটমেন্ট (BIN রেজিস্ট্রেশনের জন্য)

সতর্কতা:

সব নথি সঠিকভাবে প্রস্তুত ও জমা দিতে হবে, যাতে প্রক্রিয়ায় বিলম্ব না হয়।

RETURN FILING REQUIREMENTS

ANNUAL RETURN

Every private limited company in Bangladesh is required to submit an annual return to the Registrar of Joint Stock Companies and Firms (RJSC). This return must be filed following the Annual General Meeting (AGM), which should be held within 18 months from the date of the company’s incorporation. Subsequently, no more than 15 months may elapse between one AGM and the next. The annual return includes Schedule X, which contains a summary of share capital and lists of shareholders and directors. This must be submitted within 21 days of the AGM. Additionally, the company must file its balance sheet and profit & loss account within 30 days of the AGM.

বার্ষিক রিটার্ন (Annual Return)

বাংলাদেশে প্রতিটি প্রাইভেট লিমিটেড কোম্পানিকে Registrar of Joint Stock Companies and Firms (RJSC)-এ বার্ষিক রিটার্ন দাখিল করতে হয়।

বার্ষিক রিটার্ন Annual General Meeting (AGM) অনুষ্ঠিত হওয়ার পর দাখিল করতে হয়।

AGM কোম্পানি ইনকর্পোরেশনের ১৮ মাসের মধ্যে অনুষ্ঠিত হতে হবে।

এক AGM থেকে পরবর্তী AGM-এর মধ্যে সর্বাধিক ১৫ মাস পার হতে পারবে না।

বার্ষিক রিটার্নে অন্তর্ভুক্ত থাকে Schedule X, যা শেয়ার ক্যাপিটাল সংক্ষেপ এবং শেয়ারহোল্ডার ও ডিরেক্টরের তালিকা ধারণ করে।

AGM-এর ২১ দিনের মধ্যে বার্ষিক রিটার্ন দাখিল করতে হবে।

এছাড়াও, AGM-এর ৩০ দিনের মধ্যে কোম্পানির ব্যালান্স শীট ও প্রফিট অ্যান্ড লস অ্যাকাউন্ট দাখিল করতে হবে।

REGULAR RETURN

In the event of any changes within the company, such as alterations in the board of directors, the shareholder structure, or other significant amendments, a regular return must be filed. This return should be submitted to the RJSC within a specified period to ensure that the company’s records are up-to-date. The forms required for such filings include Form III for notices of consolidation, division, subdivision, or conversion into stock of shares, which must be filed within 15 days of the change. Changes to the registered office must be reported using Form VI within 28 days of the change.

রিটার্ন দাখিলের শর্তাবলি (Return Filing Requirements)

বার্ষিক রিটার্ন (Annual Return)

বাংলাদেশের প্রতিটি প্রাইভেট লিমিটেড কোম্পানিকে Registrar of Joint Stock Companies and Firms (RJSC)-এ বার্ষিক রিটার্ন দাখিল করতে হয়।

বার্ষিক রিটার্ন Annual General Meeting (AGM) অনুষ্ঠিত হওয়ার পর দাখিল করতে হয়।

AGM কোম্পানি ইনকর্পোরেশনের ১৮ মাসের মধ্যে অনুষ্ঠিত হতে হবে।

এক AGM থেকে পরবর্তী AGM-এর মধ্যে সর্বাধিক ১৫ মাস পার হতে পারবে না।

বার্ষিক রিটার্নে অন্তর্ভুক্ত থাকে Schedule X, যা শেয়ার ক্যাপিটাল সংক্ষেপ এবং শেয়ারহোল্ডার ও ডিরেক্টরের তালিকা ধারণ করে।

AGM-এর ২১ দিনের মধ্যে বার্ষিক রিটার্ন দাখিল করতে হবে।

এছাড়াও, AGM-এর ৩০ দিনের মধ্যে কোম্পানির ব্যালান্স শীট ও প্রফিট অ্যান্ড লস অ্যাকাউন্ট দাখিল করতে হবে।

নিয়মিত রিটার্ন (Regular Return)

কোম্পানির মধ্যে কোনো পরিবর্তন হলে, যেমন—

বোর্ড অফ ডিরেক্টরসের পরিবর্তন

শেয়ারহোল্ডার স্ট্রাকচারের পরিবর্তন

অন্যান্য গুরুত্বপূর্ণ সংশোধন

তখন নিয়মিত রিটার্ন RJSC-এ নির্ধারিত সময়ের মধ্যে দাখিল করতে হয়।

প্রয়োজনীয় ফর্মসমূহ:

Form III: শেয়ার কনসোলিডেশন, ডিভিশন, সাবডিভিশন বা স্টকে রূপান্তরের বিজ্ঞপ্তির জন্য; পরিবর্তনের ১৫ দিনের মধ্যে দাখিল করতে হবে।

Form VI: নিবন্ধিত অফিসের পরিবর্তন; পরিবর্তনের ২৮ দিনের মধ্যে রিপোর্ট করতে হবে।

ADDITIONAL FILING REQUIREMENTS

Private limited companies are also obligated to file various other documents depending on specific circumstances:

- Form IX, regarding the consent of directors to act, must be submitted within 30 days of appointment.

- Form XV, concerning the return of allotment, should be filed within 60 days of allotment.

- For any mortgages or charges created or modified, Form XVIII and Form XIX must be filed within 21 days of the creation or modification.

These requirements ensure that the RJSC has all the necessary information to maintain accurate and current records of all registered companies in Bangladesh.

অতিরিক্ত রিটার্ন দাখিলের শর্তাবলি (Additional Filing Requirements)

প্রাইভেট লিমিটেড কোম্পানিগুলিকে নির্দিষ্ট পরিস্থিতি অনুযায়ী অন্যান্য নথিও দাখিল করতে হয়:

Form IX: ডিরেক্টরদের কর্ম করার সম্মতি সম্পর্কিত; নিয়োগের ৩০ দিনের মধ্যে জমা দিতে হবে।

Form XV: শেয়ার বরাদ্দের রিটার্ন সম্পর্কিত; বরাদ্দের ৬০ দিনের মধ্যে দাখিল করতে হবে।

Form XVIII ও Form XIX: যেকোনো মর্টগেজ বা চার্জ তৈরি বা সংশোধনের ক্ষেত্রে; তৈরি বা সংশোধনের ২১ দিনের মধ্যে দাখিল করতে হবে।

এই শর্তাবলি নিশ্চিত করে যে RJSC-এর কাছে বাংলাদেশে নিবন্ধিত সকল কোম্পানির সঠিক ও আপ-টু-ডেট তথ্য আছে।

CONCLUSION

Throughout the detailed journey of establishing a private limited company in Bangladesh, we have navigated the intricate landscape of pre-registration criteria, the pivotal role of the Registrar of Joint Stock Companies and Firms (RJSC), and the crucial steps for achieving a successful registration. The structured step-by-step guide underscores not only the importance of meticulous planning and adherence to legal requirements but also highlights the significance of understanding the nuanced roles of directors, shareholders, and the criticality of capital requirements. This comprehensive exploration empowers entrepreneurs with the essential knowledge to embark on their business ventures with confidence and legal acumen.

উপসংহার (Conclusion)

বাংলাদেশে একটি প্রাইভেট লিমিটেড কোম্পানি স্থাপনের বিস্তারিত যাত্রাপথে আমরা প্রাক-নিবন্ধন শর্তাবলি, RJSC-এর গুরুত্বপূর্ণ ভূমিকা, এবং সফল নিবন্ধনের জন্য প্রয়োজনীয় ধাপসমূহ সম্বন্ধে বিশদভাবে আলোচনা করেছি।

ধাপে ধাপে গাইডটি শুধু সঠিক পরিকল্পনা ও আইনগত শর্তাবলির প্রয়োজনীয়তা তুলে ধরেনি, বরং ডিরেক্টর, শেয়ারহোল্ডার এবং মূলধনের শর্তাবলির সূক্ষ্ম দিকগুলো বোঝার গুরুত্বও হাইলাইট করেছে।

এই সম্পূর্ণ বিশ্লেষণ উদ্যোক্তাদেরকে প্রয়োজনীয় জ্ঞান প্রদান করে, যাতে তারা আত্মবিশ্বাস এবং আইনগত দক্ষতার সঙ্গে তাদের ব্যবসায়িক যাত্রা শুরু করতে পারেন।

CHECKLIST FOR PRIVATE LIMITED COMPANY REGISTRATION IN BANGLADESH.

- National ID / Passport

- TIN Certificate

- Photo (Passport Size)

- Contact Number

- Email Address

- Present Address

- Permanent Address

- Share Percentage

- Father’s Name

- Mother’s Name

- Company’s proposed name.

- Company’s Authorized Capital.

- Company’s Paid-up Capital.

- Nature of Business of the Proposed Company in Details.

- Registered Address of the Proposed Company.

- Above Mentioned Information (Serial No. 1 to 9) of Each Director.

For more details, please get in touch with us at +88 01713 560065